Q. What are the Nidhi Limited Companies and how it works?

NIDHI Limited Companies are a type of Non-Banking Financial Company (NBFC) in India, formed for the benefit of its members. The primary objective of Nidhi Companies is to promote the habit of thrift and savings among its members by providing them with financial assistance at a reasonable interest rate.

Note: – These companies do not require any license from the Reserve Bank of India (RBI) to operate.

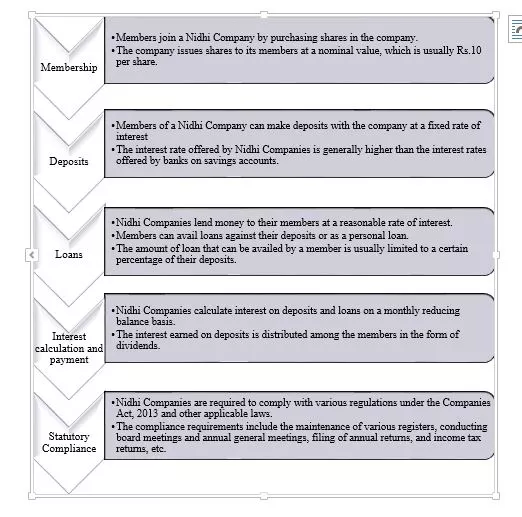

WORKING OF NIDHI LIMITED COMPANIES

- conducted in accordance with the rules and regulations specified in the Companies Act.

- Conducting board meetings: Nidhi companies are required to hold at least four board meetings in a year, with a maximum gap of 120 days between two consecutive meetings.

- Statutory Registers: Nidhi Companies are required to maintain various statutory registers, such as the Register of Members, Register of Deposits, Register of Loans and Advances, Register of Directors and Key Managerial Personnel, etc.

- Filing of Annual Returns: Nidhi Companies are required to file annual returns with the Registrar of Companies (ROC) within 60 days from the date of the AGM.

- Income Tax Returns: Nidhi Companies are required to file income tax returns with the Income Tax Department every year.

Note:-

- Non-compliance with these compliances can lead to penalties, fines, and even the cancellation of the registration of the Nidhi Company.

- Therefore, it is important for Nidhi Companies to ensure that they comply with all the applicable laws and regulations.

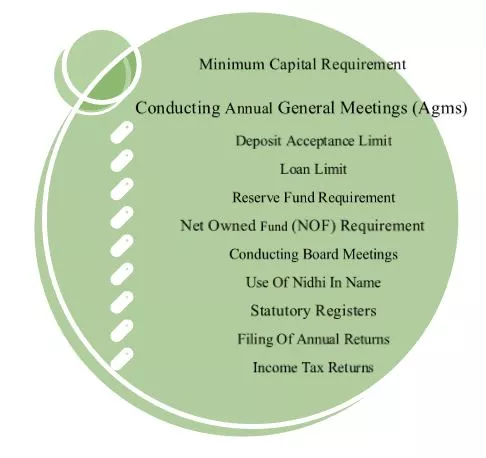

NIDHI COMPANIES COMPLIANCES

Nidhi Companies in India are required to comply with various regulations under the Companies Act, 2013 and other applicable laws.

Here are some key Nidhi Companies Compliances

Some of the key Nidhi Company compliances are as follows:

- Minimum Capital Requirement: As per the Companies Act, 2013, the minimum paid-up equity share capital required to start a Nidhi Company is Rs. 5 Lakhs. It is also mandatory for a Nidhi Company to have unencumbered term deposits of at least 10% of the outstanding deposits.

- Use of Nidhi in Name: Every Nidhi Company shall use the words “Nidhi Limited” as part of its name.

- Net Owned Fund (NOF) Requirement: As per the RBI guidelines, a Nidhi Company is required to maintain a minimum NOF of Rs.10 Lakhs.

- Deposit Acceptance Limit: A Nidhi Company can accept deposits from its members only up to 20 times of its NOF.

- Loan Limit: The maximum amount of loan that a Nidhi Company can provide to its members should not exceed 2 times the NOF.

- Reserve Fund Requirement: Every Nidhi Company should create a reserve fund and transfer at least 20% of its profits every year to this fund until the reserve fund reaches 50% of the NOF.

- Conducting annual general meetings (AGMs): Nidhi companies are required to hold an AGM within six months of the end of the financial year. The AGM should be conducted in accordance with the rules and regulations specified in the Companies Act.

- Conducting board meetings: Nidhi companies are required to hold at least four board meetings in a year, with a maximum gap of 120 days between two consecutive meetings.

- Statutory Registers: Nidhi Companies are required to maintain various statutory registers, such as the Register of Members, Register of Deposits, Register of Loans and Advances, Register of Directors and Key Managerial Personnel, etc.

- Filing of Annual Returns: Nidhi Companies are required to file annual returns with the Registrar of Companies (ROC) within 60 days from the date of the AGM.

- Income Tax Returns: Nidhi Companies are required to file income tax returns with the Income Tax Department every year.

Note:-

- Non-compliance with these compliances can lead to penalties, fines, and even the cancellation of the registration of the Nidhi Company.

- Therefore, it is important for Nidhi Companies to ensure that they comply with all the applicable laws and regulations.

INCORPORTION OF NIDHI LIMITED

Q. How it was incorporate? And what are the steps of incorporation?

PROCESS OF INCORPORATION

LIMITATIONS

- Limited Lending Capacity: Nidhi Companies are limited in their lending capacity as they can only lend to their members. This means that the loan portfolio of Nidhi Companies is typically small, which can limit the scope of their operations.

- Limited Geographical Reach: Nidhi Companies are typically small and operate in a limited geographical area. This can be a disadvantage for individuals who live in areas where Nidhi Companies are not present.

- Limited Product Offering: Nidhi Companies have limited product offerings compared to other financial institutions like banks and NBFCs. This can be a disadvantage for individuals who require a wide range of financial products and services.

- Limited Marketability: The shares of a Nidhi Company are restricted to its members only and cannot be freely traded on the stock exchange. This can limit the marketability of the shares and reduce their liquidity.

- Regulatory Compliance: Although Nidhi Companies have fewer compliance requirements compared to other financial institutions like NBFCs, they are still subject to certain regulatory compliance requirements. Failure to comply with these requirements can result in penalties and legal consequences.

- Limited Profitability: Nidhi Companies are non-profit organizations, which means that they cannot distribute profits to their members. This can be a disadvantage for individuals who are looking for investment opportunities that offer higher returns.

- Limited Ownership: Nidhi Companies are owned by their members who hold shares in the company. This means that the ownership of the company is limited to its members only, which can limit the potential for growth.

Q. Why should we choose Nidhi Limited over the other NBFC Companies?

Here are some reasons why one might choose Nidhi Limited over an NBFC:

REASONS

I) Interest Rates: Nidhi Companies typically offer lower interest rates on loans compared to NBFCs. This makes it an attractive option for individuals who are looking for affordable credit.

II) Deposit Rates: Nidhi Companies offer higher rates of interest on deposits compared to NBFCs. This can be beneficial for individuals who want to earn a higher rate of interest on their savings.

III) Membership Benefits: Nidhi Companies offer membership benefits to their members, which can include access to loans at lower interest rates, access to financial education, and other benefits.

This can be attractive for individuals who are looking for a sense of community and long-term financial planning.

IV) Geographical Reach: Nidhi Companies are typically small and operate in a limited geographical area. This can be beneficial for individuals who live in small towns and villages and may not have access to credit or financial services from larger NBFCs.

V) Compliance Requirements: Nidhi Companies are subject to fewer compliance requirements compared to NBFCs. This makes it easier for them to operate and can result in lower operational costs, which may be reflected in the interest rates offered to borrowers.

Note: –

It’s important to note that Nidhi Companies are not a substitute for NBFCs, and the choice between the two depends on the individual’s financial requirements.

For example, if a borrower requires a large loan amount, an NBFC may be a more suitable option. On the other hand, if a borrower wants to save money and earn a higher rate of interest, a Nidhi Company may be a better option. Ultimately, it’s important to evaluate the specific terms and conditions offered by each lender before making a decision.

DOCUMENTATION

The documents required for Nidhi Limited registration are as follows:

- Identity Proof: A copy of the PAN card of all directors and shareholders is required.

- Address Proof: A copy of the Aadhar card/ passport/ voter ID/ driving license/ utility bills (not older than two months) is required for all directors and shareholders.

- Passport Size Photographs: Two passport-size photographs are required for all directors and shareholders.

- Registered Office Address Proof: A copy of the rental agreement or sale deed of the registered office, along with a No Objection Certificate (NOC) from the landlord is required.

- MoA and AoA: The Memorandum of Association (MoA) and Articles of Association (AoA) of the company need to be prepared and submitted.

- Declaration: A declaration needs to be submitted by the directors stating that they have not been convicted of any offense and that all the information provided is true and correct.

- Digital Signature Certificate (DSC): DSC of all directors and shareholders is required for filing the application.

- Director Identification Number (DIN): DIN needs to be obtained for all directors of the company.

- Nidhi Company Registration Form: The Nidhi Company Registration Form needs to be filled and submitted with the Registrar of Companies (ROC).

Rules and Regulations

Nidhi Companies are governed by a set of rules and regulations to ensure their proper functioning and to protect the interests of their members.

Some of the key rules and regulations governing Nidhi Companies are:

- Companies Act, 2013: Nidhi Companies are registered under the Companies Act, 2013, which sets out the legal framework for their functioning.

- Nidhi Rules, 2014: The Ministry of Corporate Affairs (MCA) has prescribed certain rules for Nidhi Companies under the Companies Act, 2013. These rules set out the requirements for incorporation, membership, and other operational aspects of Nidhi Companies.

- RBI Guidelines: The Reserve Bank of India (RBI) has also issued guidelines for Nidhi Companies, which cover aspects such as minimum net owned funds, deposit limits, lending limits, etc.

- Income Tax Act, 1961: Nidhi Companies are required to comply with the provisions of the Income Tax Act, 1961, which set out the tax obligations of companies.

- Anti-Money Laundering (AML) Guidelines: Nidhi Companies are also required to comply with AML guidelines issued by the RBI and the government, which aim to prevent money laundering and terrorist financing.

- KYC Requirements: Nidhi Companies are required to comply with Know Your Customer (KYC) requirements for their members, which involve verifying the identity and address of members.

- Accounting Standards: Nidhi Companies are required to follow the accounting standards prescribed by the Institute of Chartered Accountants of India (ICAI).

Note: – It’s important for Nidhi Companies to comply with these rules and regulations to ensure their proper functioning and to avoid penalties and legal issues.

Companies that fail to comply with these regulations may face fines, penalties, or even the revocation of their registration.

NIDHI LIMITED FORMS

In the context of Nidhi Companies in India, there are several forms that need to be filed with the Registrar of Companies (ROC) for various purposes.

| Forms | Time limit | Explanation |

| NDH 1 | Within 90 days of closure First / second financial year | Nidhi Company requires to file with the registrar of companies a return of statutory compliances |

| NDH 2 | Within 30 days of closure first financial year | If Nidhi Company has complied with requirements of Rule 5(1), it is required to file with registrar for an extension of time |

| NDH 3 | 30th October Or 30th April | Nidhi Company requires to file half yearly return |

| NDH 4 | Nidhi Company incorporated on or after Nidhi Amendment Rules, 2019 within 60 days from the date of expiry of 1 year from the incorporation or the period up to which the extension. Nidhi Company incorporated before the Amendment- up to 15th February 2020 | The Nidhi Company requires to file this form with the registrar and central government after being satisfied that it satisfies the compliances/requirements. Failure to file this form restricts filing of some other forms too. |

| AOC 4 | Within 30 days of AGM (Annual General Meeting) | Nidhi Company requires to file a financial statement along with the Directors report, extract of annual return and financial statements of the company. |

| MGT 7 | Within 30 days of approval of the director’s report by the Board | Nidhi Company requires to file this form with registrar of companies |

| MGT 14 | Within 30 days of approval of director’s report by the Board | Nidhi Company requires to file this form with registrar of companies |

| DIR 3 KYC | Up to 30th September | Nidhi Company requires to file this form with registrar of companies for every director of the company. |

CONCLUSION

In conclusion, a Nidhi Company is a type of non-banking financial company that is regulated by the Ministry of Corporate Affairs in India. The incorporation process of a Nidhi Company involves obtaining the necessary approvals and registering with the Registrar of Companies.

Nidhi Companies have several advantages, including limited liability for members, lower capital requirements, and higher interest rates on deposits. However, they also have certain disadvantages, such as limited investment options and restrictions on the number of members.

Compliance with the Nidhi Rules, 2014 is a crucial aspect of running a Nidhi Company. The Nidhi Rules specify various forms that need to be filed by Nidhi Companies with the Registrar of Companies, such as NDH-1, NDH-2, NDH-3, NDH-4, MGT-7, AOC-4, and MGT-14 among others.

Companies must comply with the filing requirements within the specified timelines to avoid penalties and legal issues. Seeking the assistance of professionals such as company secretaries or chartered accountants can help ensure proper compliance with these requirements.